Solutions for the mobility industry

Services, SaaS applications and digitized system solutions for your fleet

PS Team is the perfect partner for your process optimization

Strategy and operations – we are experts in both!

With our sophisticated system solutions, we generate high savings potential and time optimizations through central process management from a single source for large vehicle fleets, full-service leasing companies, car rental companies, car manufacturers and car dealerships.

Customer groups

For over 35 years, our customers have included companies from across the mobility industry. In addition to car manufacturers, car dealerships, car rental companies, car subscription providers, leasing companies and online platforms, we also support many other companies with their own vehicle fleets.

PS Team keeps the mobility industry up to speed

Services for the mobility industry

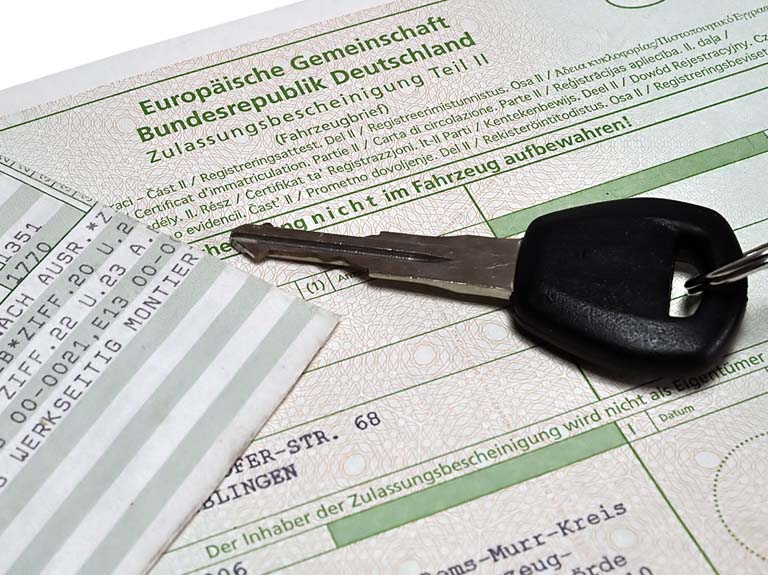

We acquire and return vehicles, coordinate your vehicle transport – including international orders – and manage your vehicle documents with great care.

We also take care of traffic ticket management and more time- and cost-intensive tasks for you. To achieve this, we deploy consistently user-friendly system solutions – for more efficiency and complete transparency in your fleet.

Your benefits

Prevent fraud, reduce costs, retain customers

SaaS

Use software without buying it

Nowadays, obtaining software as a service via the cloud has almost become the norm. This reduces hardware costs and allows the user to access their programs via different end devices. The SaaS (Software as a Service) method offers a good alternative for our special applications in particular.

Arrange a no-obligation consultation today